Assisted Driving Systems Are Powering a Million Kilometers a Day in China’s Autonomous Trucking

- Oprac. M.K.

- Kategoria: English zone

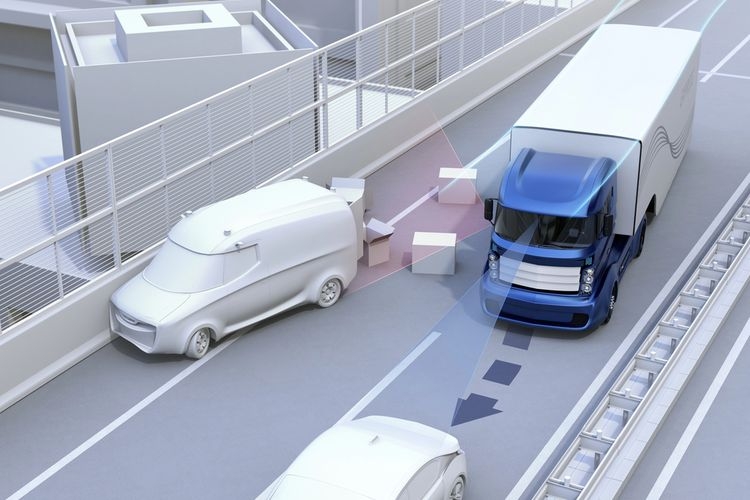

Across the global autonomous vehicle landscape, commercial trucks are emerging as one of the first segments to reach true-scale deployment. While regulatory and liability concerns continue to slow the rollout of higher automation levels in passenger cars, the freight sector presents a clearer path to monetization, its routes are fixed, operational costs are measurable, and efficiency gains are directly linked to profitability.

In the U.S. and Europe, companies such as Aurora, Plus, and TuSimple are advancing pilot programs and OEM integration. Meanwhile, in China, the pace of adoption has accelerated dramatically: trucks equipped with assisted driving systems now collectively log over one million kilometers every day.

To gain deeper insights into this rapid transformation, Shihao Fu, an analyst specializing in autonomous driving at IDTechEx, recently visited Inceptio Technology, a leading Chinese autonomous trucking company. During the visit, IDTechEx toured Inceptio’s R&D and testing headquarters in Shanghai and experienced first-hand the company’s latest mass-produced L2+ driver assistance system in real-world highway operation.

Global Exploration and the Chinese Path

Around the world, autonomous trucking faces two persistent hurdles: the long commercialization timeline of Level 4 fully driverless systems and the slow adaptation of regulatory frameworks to real-world operations. In contrast, China’s logistics ecosystem, characterized by high freight density and flexible policy support, has enabled a distinctive pathway: “assist first, automate later.”

Inceptio exemplifies this approach. Since launching its commercialization pilots in 2021, the company has scaled its proprietary Xuanyuan autonomous driving system through mass-production programs with major OEMs such as Dongfeng, Sinotruk, and Foton. The system now represents roughly 50% of production volume across its partner models, with cumulative autonomous mileage exceeding 300 million kilometers. By focusing on Level 2+ assistance first, Inceptio has lowered barriers to large-scale deployment while continuously collecting real-world data for algorithm refinement and long-term autonomy development.

The Economics of L2+ and Operational Impact

In China’s long-haul freight network, delivery time and labor cost define profitability. Traditionally, routes under 1,000 kilometers rely on two alternating drivers, while longer routes depend on “relay” or “drop-and-hook” operations involving multiple drivers and trucks. Inceptio’s L2+ system directly addresses these pain points by reducing fatigue and extending safe driving hours.

Real-world data show that the system achieves over 90% engagement on highways, reducing fuel consumption by around 3% and accidents by up to 94% compared with manual driving. For example, on the 800-kilometer Nanchang–Shanghai corridor, a route that used to require two trucks and four drivers can now be completed by a single L2+-equipped vehicle with one driver. This effectively halves the driver-to-truck ratio from 2:1 to 1:1, lowering labor costs by approximately 50%.

On the longer Guangzhou–Luohe (north China) route (approximately 1,300 kilometers), Inceptio introduced an automated relay model with a transfer hub in Wuhan, reducing the number of drivers required from six to four. This optimization not only improved overall transport efficiency but also allowed drivers to enjoy longer and more regular rest periods.

From a financial standpoint, a fleet operator pays roughly RMB 100,000 (≈ US$14,000) in additional upfront cost for the L2+ option. Over a 4- to 6-year total cost of ownership (TCO) cycle, the system can reduce labor expenditure by around 40%, while also enhancing driver comfort and safety. For many logistics companies, this represents a pragmatic step toward automation, one that delivers measurable returns today.

Safety, Insurance, and Market Confidence

Safety remains the key determinant of trust in autonomous and semi-autonomous technologies. In China’s commercial trucking sector, traditional insurance payout ratios hover around 90%, reflecting historically high accident frequencies. In comparison, fleets monitored by Inceptio report payout ratios of below 10%. Although the dataset is still limited, insurers are beginning to recognize assisted driving as a credible means of risk reduction and operational stability.

From a global perspective, this incremental, data-driven route to commercialization is gaining traction across markets. Inceptio’s case illustrates how China’s logistics environment, supported by dense freight corridors, OEM integration, and regulatory flexibility, enables assisted driving to deliver near-term economic and safety benefits while paving the way for higher levels of autonomy.

The findings presented here stem from IDTechEx’s on-site visit and in-depth interviews with Inceptio Technology. IDTechEx continues to track the worldwide evolution of autonomous driving technologies from passenger cars to heavy trucks, and from sensor integration to regulatory development, providing independent research and market intelligence to the industry.

For more detailed analysis of autonomous trucking commercialization, technology roadmaps, and long-term forecasts, see the IDTechEx report: Autonomous Trucks 2024–2044: Market, Forecasts, Technologies, Players.